A modification to the tax code known as Section 24 that impacts the amount of tax relief that landlords receive was revealed to the public in 2015. The change was implemented gradually, but it became effective in its entirety in April 2020.

Here we examine the operation of Section 24, how it impacts rental revenue, and what remedies are available. Simply put, Section 24 eliminates a landlord’s ability to deduct mortgage interest and other financing expenses (including mortgage arrangement fees) from rental income before determining their tax liability. Landlords will only be able to claim a 20% tax credit based on their loan and mortgage interest beginning with the 2020–2021 tax year.

Why was section 24 introduced?

Section 24, introduced in 2015, aims to level the playing field by removing what was considered an advantage for landlords with higher incomes. Then-Chancellor George Osborne highlighted this perceived inequality in the Summer Budget 2015.

Osborne’s reasoning was straightforward: he pointed out that buy-to-let landlords enjoyed a significant advantage in the property market as they could deduct mortgage interest payments from their income, a benefit not available to homebuyers. Moreover, the wealthier the landlord, the greater the tax relief they received. This, in his view, created an imbalance in the tax system.

Tax relief changes explained

Income derived from residential rental properties is subject to Section 24 of the UK tax code, which has significantly altered the tax landscape for landlords. Under this legislation, landlords no longer enjoy the same level of tax relief as before.

In the pre-Section 24 era, landlords could deduct mortgage interest from their income tax obligations. Additionally, they could claim deductions for other expenses associated with rental properties, including mortgage administrative fees or loans for furniture purchases.

However, the implementation of Section 24 mandates that landlords pay tax on the entirety of their rental income. They can only claim back mortgage interest costs, and even then, the relief is capped at 20%—equivalent to the basic rate of income tax.

Consequently, landlords now face higher upfront tax payments. Moreover, if they have another source of income, such as a salary from another job, these rental income increases may push them into a higher tax bracket, resulting in a higher overall tax liability.

In essence, the role of Section 24 is to disallow landlords from offsetting finance charges against their gross profit when determining their tax liabilities. This change translates to increased tax payments. It’s important to note that the loss of tax relief could potentially propel a landlord, teetering on the edge of a higher tax bracket, into that next tax band.

Furthermore, the uptick in gross income may have ripple effects on other financial aspects, such as student loan repayments, child tax credits, and child benefits, all of which can be influenced by changes in income levels.

What finance cost tax relief do landlords get in 2023?

Under the revised tax rules introduced by Section 24, landlords are eligible for a 20% tax credit based on the lower of three factors:

1. Finance costs, which include mortgage interest, interest on loans for furnishing purchases, and fees associated with mortgages or loans.

2. Property business profits.

3. Adjusted total income.

This change essentially means that landlords can no longer deduct their full finance costs, including mortgage interest, from their rental income for tax purposes. Instead, they receive a 20% tax credit on the lowest value among these three elements.

Who will be affected by section 24 and its tax relief?

These tax relief rules have broad applicability, affecting individual landlords within the private rented sector. This includes various scenarios:

- UK-resident landlords who rent out properties in the UK or abroad.

- Non-UK resident landlords who rent out properties in the UK.

- Landlords who let properties through partnerships.

- Landlords who operate as limited liability companies, subject to a different tax system, allowing them to declare rental income after accounting for mortgage costs.

The government’s policy paper on finance cost relief estimated that only a fifth of individual landlords would experience reduced relief under the new regulations. It’s noteworthy that the higher-earning landlords would bear the primary impact of these changes.

As a result of these alterations, landlords are now liable to pay tax on their gross rental income, potentially causing some to transition into a higher tax bracket.

How has the government responded to the petition asking for the full tax relief to be reinstated?

The impact of section 24 on the rental property market has prompted many landlords to voice their concerns by signing a petition. The petition emphasizes the consequences of section 24 on the industry’s rental stock and the potential benefits of reinstating full relief.

Signatories of the petition, including Marc von Grundherr, Director of Benham and Reeves, highlight the significant influence of these changes. According to a survey of landlords, 73% of those considering exiting the sector would reconsider their decision if the section 24 alterations were reversed.

In response, the government has maintained its stance, asserting that it will persist in setting mortgage interest relief against rental income at the basic rate of tax. The government’s rationale behind this decision is to uphold fairness within the income tax system. It aims to avoid providing landlords with certain advantages that go beyond what is afforded to homeowners, which was the original intent of the changes.

While the petition still has a journey ahead, it could potentially lead to a parliamentary debate if it garners 100,000 signatures.

What Exactly is the Change in Interest Relief?

Prior to the tax year 2016/17, individual residential landlords were taxed based on their net rental profits. This net profit calculation involved subtracting all eligible property expenses and mortgage interest from the gross rental income.

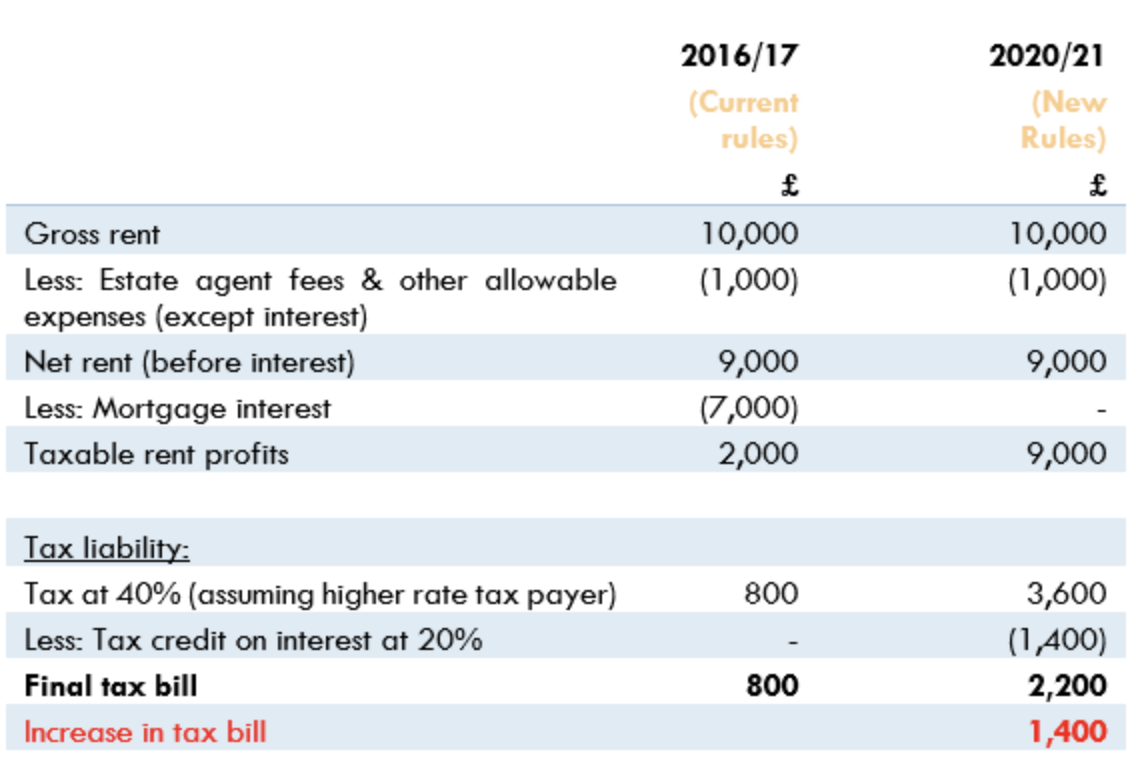

“So, if you have rental income of £10,000, estate agent fees & other allowable expenses of £1,000 and mortgage interest of £7,000, your net rental profits will be £2,000, and you pay tax on this. Assuming you are higher rate tax payer, your income tax liability will be £800 (40% of the net rental profit of £2,000).”

Due to the gradual implementation of interest rate relief restrictions starting from the tax year 2016/17 and reaching full effect in the tax year 2020/21, landlords are no longer permitted to deduct mortgage interest as an expense. Instead, they receive a tax credit at a rate of 20% against their tax liability.

In the example provided, net rental profits amount to £9,000, considering that mortgage interest is no longer deductible. Consequently, the tax liability at a rate of 40% reaches £3,600 before accounting for the credit on mortgage interest.

Landlords receive a tax credit for mortgage interest totaling £1,400, which corresponds to 20% of the £7,000 mortgage interest. Consequently, the net tax liability stands at £2,200, representing a substantial 175% increase in tax liability compared to the previous system.

Under the new system of interest relief restriction, landlords may find themselves facing a tax bill of £2,200, even though their net rental income after accounting for interest stands at only £2,000. This results in a loss of £200 after tax, and the effective tax rate on net rental profits reaches a staggering 110%.

In certain cases, this effective tax rate can soar to 220%. This marks the reality of the new world of interest relief restriction. Ironically, the government’s intention behind these changes was to create a fairer tax system.

Credits to https://www.ukpropertyaccountants.co.uk/ for this example. You may visit https://www.ukpropertyaccountants.co.uk/section-24-mortgage-interest-relief-restriction-landlords/ for the full guide.

What can I do to lessen the effect of Section 24 on my portfolio and manage the changes on Interest Relief?

Raising the rent might seem like a solution to offset the impact of Section 24, but it may not always be effective. Here’s why:

1. Market Dynamics: Rental rates are influenced by the market. Overpricing your property could lead to longer vacancies, resulting in financial losses during void periods. It’s crucial to align your rent with prevailing market rates to attract tenants promptly.

2. Property Upgrades: To justify higher rent, you might consider costly property improvements. However, this could inadvertently lower your property’s value and potentially push you into a higher tax bracket.

Given the changes in Section 24, landlords can explore alternative strategies to mitigate its impact:

1. Review Operating Expenses: Reduce property operating costs to compensate for rising taxes. Managing the property yourself, rather than hiring a management company, can be a cost-effective option.

2. Remortgage: Assess your entire mortgage expenses and seek a more affordable loan, which can help reduce the overall financial burden caused by Section 24.

3. Consider Commercial Property: Section 24 primarily applies to residential real estate, so diversifying into commercial property investments may help you avoid these restrictions.

Each landlord’s situation is unique, and the effectiveness of these measures may vary. It’s advisable to consult with financial and property experts to determine the best approach for your specific circumstances.

MORE Buy To Let blogs HERE:

Buy To Let Defaults Surge with Rising Rates

Cashing Out of Buy To Let? Top Places to Make a Quick Sale

Why Are Buy-to-Let Mortgages Interest Only?

Is Buy-to-Let Still Profitable Today?

A Comprehensive Guide to Buy-to-Let Mortgages

First-Time Buyer’s Guide to Buy-to-Let Mortgages

Should You Invest in Property Now or Wait for 2024?

How Much Do You Need for Buy-to-Let Mortgages?

Stamp Duty on Buy-to-Let Properties

Can I Use Equity As A Deposit For Buy To Let?

Can I Buy A House And Renting It Out UK?

Is renting houses profitable UK in 2023?